Unlocking the Future of Property Investment: Fractional Real Estate Through Tokenization

In today's fast-evolving financial landscape, real estate investment no longer requires deep pockets or exclusive access to high-value properties. At Xskape Finance, we've spent over 17 years helping Australians navigate property financing through trusted, word-of-mouth networks. Now, as we embrace a digital-first approach with our revamped website, YouTube channel (@xskapebreakout), and X account (@Xskapefinance), we're excited to explore innovative ways to make real estate more accessible. Building on the educational content we've developed for our YouTube series—where we break down complex finance topics like blockchain's role in property—let's dive into real estate tokenization. This game-changing technology allows everyday investors to own a fraction of premium assets, democratizing what was once an elite market.

## What is Real Estate Tokenization?

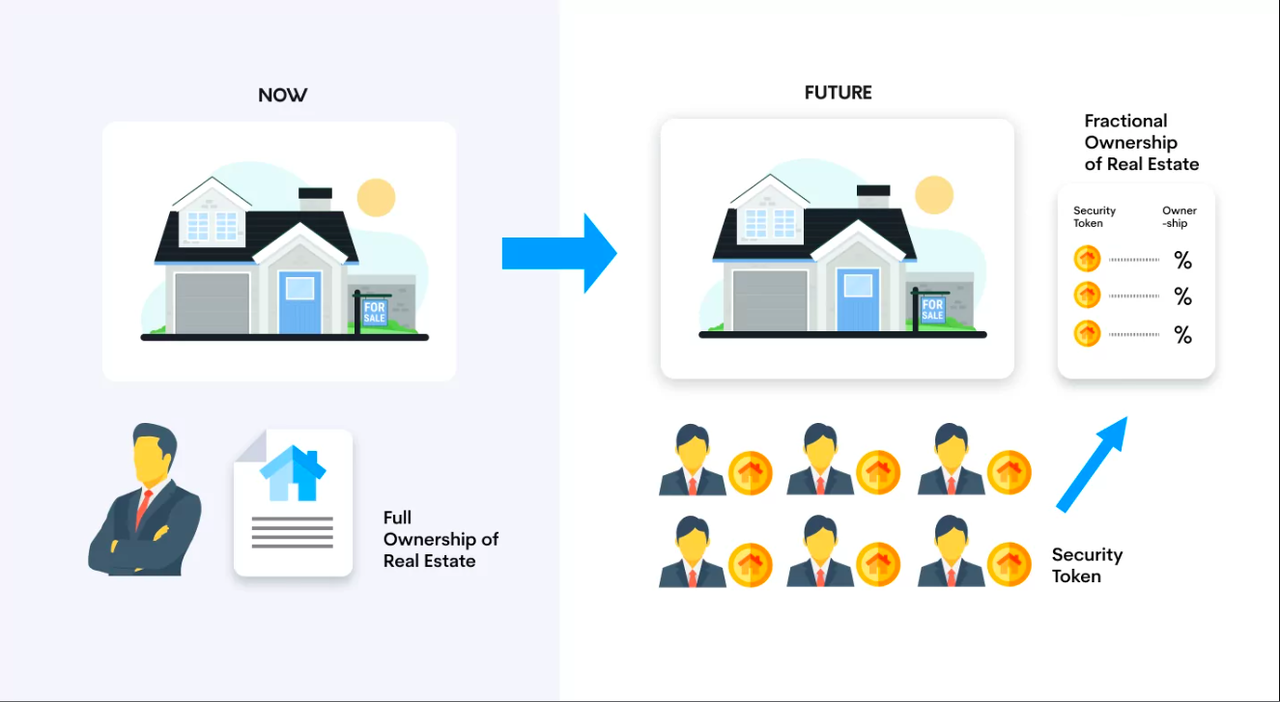

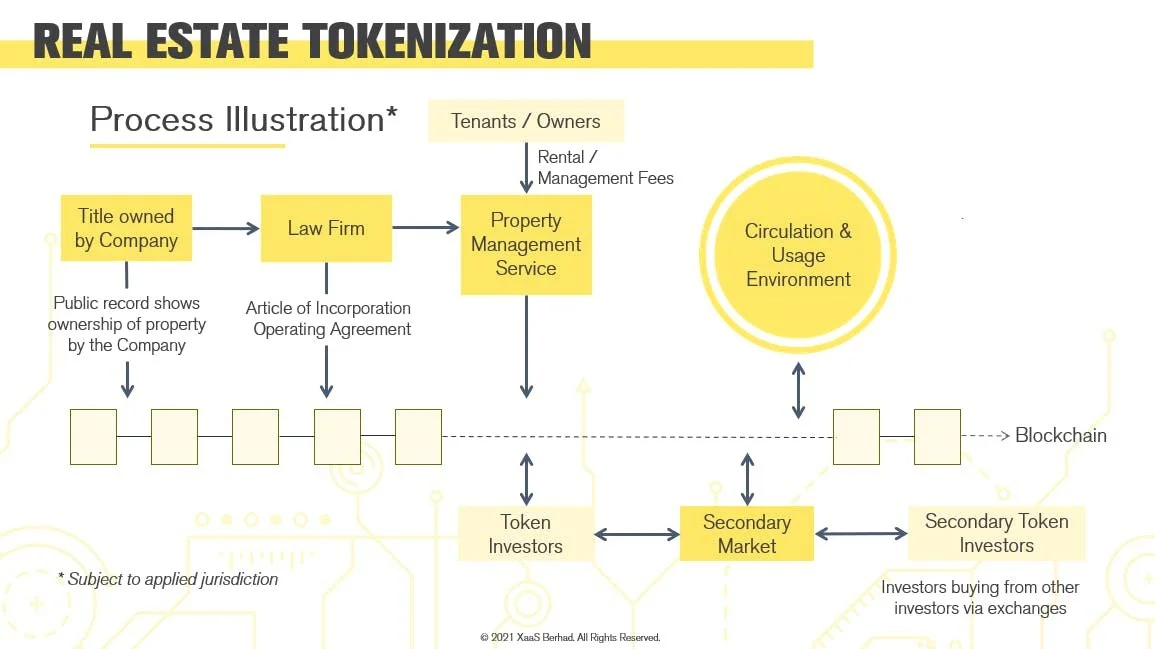

Real estate tokenization is the process of converting property ownership rights into digital tokens on a blockchain. Essentially, a physical asset like an apartment building, commercial space, or even a luxury home is divided into smaller, tradable units represented by these tokens. Instead of buying an entire property, you can purchase a "fraction" through tokens, each corresponding to a proportional share of the asset's value, rental income, and potential appreciation.

This innovation leverages blockchain technology for secure, transparent transactions, eliminating many traditional barriers like high minimum investments or lengthy paperwork. For instance, platforms tokenize properties by creating digital securities compliant with regulations, ensuring your ownership is legally backed.

To visualize this, consider how a single property can be split into thousands of tokens, much like shares in a company.

## The Benefits of Fractional Ownership

Why is this shift so revolutionary? Traditional real estate demands significant capital—often hundreds of thousands of dollars—for a single purchase. Tokenization lowers the entry point dramatically, with some platforms allowing investments as low as $100. This opens doors for younger investors, first-timers, or those diversifying portfolios without overcommitting.

Key advantages include:

- **Liquidity**: Unlike physical properties that can take months to sell, tokenized assets trade on secondary markets, often 24/7, similar to cryptocurrencies or stocks.

- **Diversification**: Own fractions across multiple properties—say, a slice of a Sydney office tower and a Melbourne residential complex—reducing risk.

- **Income Potential**: Many tokenized properties generate passive income through rents, distributed proportionally to token holders.

- **Global Access**: Blockchain transcends borders, enabling international investment without the hassles of foreign ownership laws.

As we discussed in our YouTube video on "Breaking Into Blockchain Finance" (check it out on @xskapebreakout for a step-by-step walkthrough), this model aligns perfectly with Australia's booming property market, where average home prices exceed $1 million in major cities. Tokenization could help bridge the affordability gap.

Here's an illustrative example of how fractional ownership works in practice.

Source: hackernoon.com

## How to Purchase Fractional Real Estate Tokens

Getting started is simpler than you might think. Here's a high-level guide based on established platforms:

1. **Choose a Platform**: Look for reputable ones like RealT, which specializes in U.S. properties but offers global access, or emerging Australian-focused services. Ensure they're regulated—check for compliance with ASIC guidelines in Australia.

2. **Set Up a Wallet**: You'll need a digital wallet compatible with blockchain (e.g., MetaMask) to hold tokens. Some platforms accept fiat via bank transfers.

3. **Research Properties**: Browse listings with details on location, yield, and token pricing. Due diligence is key—review audits and legal structures.

4. **Buy Tokens**: Purchase using crypto (like Ethereum) or stablecoins. Transactions are instant and recorded immutably on the blockchain.

5. **Manage Your Investment**: Track performance through the platform's dashboard, collect dividends, and sell tokens when ready.

For more hands-on advice, our YouTube channel (@xskapebreakout) features tutorials on setting up wallets and spotting quality tokenized deals, drawing from our deep expertise in property finance.

## Potential Challenges and Considerations

While promising, tokenization isn't without hurdles. Regulatory landscapes are evolving—Australia's government is increasingly supportive of blockchain, but tax implications (e.g., capital gains on token sales) must be navigated. Market volatility can affect token values, and not all platforms offer the same level of security. Always consult a financial advisor, like our team at Xskape Finance, to align this with your overall strategy.

## Why This Matters for Australian Investors

At Xskape Finance, we're not just observers; we're adapting our services to include guidance on these digital assets. Whether you're refinancing a traditional property or exploring tokenized options, our 17+ years of experience position us to help you escape financial constraints and build wealth smarter.

Ready to fractionalize your future? Subscribe to @xskapebreakout on YouTube for more insights, follow @Xskapefinance on X for updates, and visit www.xskape.com.au to connect with our experts. Let's discuss how tokenization fits into your investment journey—contact us today for a no-obligation chat.